Discount Received Journal Entry

The exceptions to this rule are the accounts Sales Returns. Party Creditors Ac Dr.

Discount Received Journal Entry Bhardwaj Accounting Academy

Discount allowed example For.

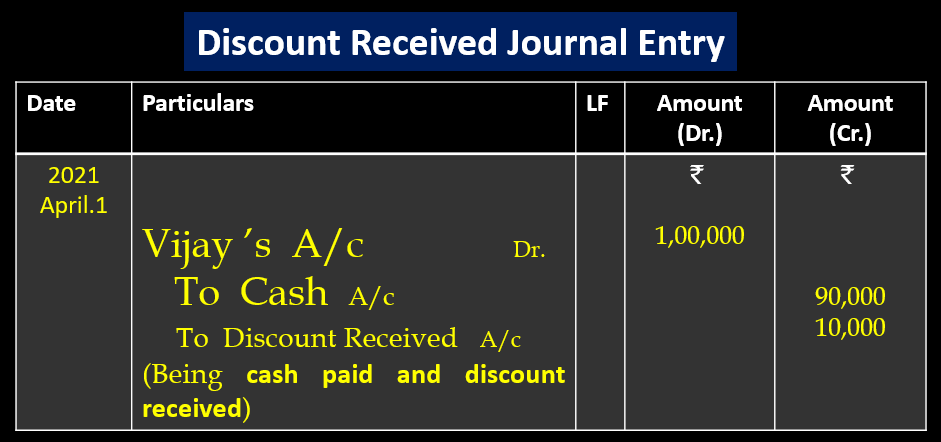

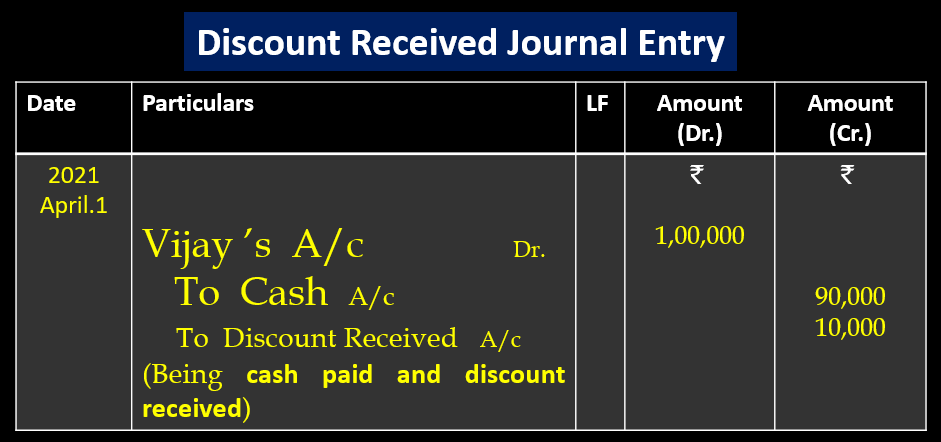

. This purchase discount of 60 will be. Discount received example For. The company can make the discount received journal entry by debiting the accounts payable and crediting the discount received account and the cash account.

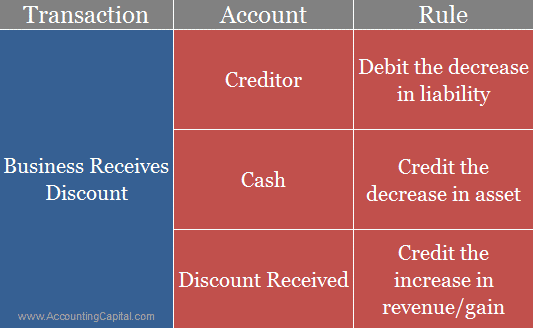

Creditors account is a personal Ac Personal Acs principle. We can make the journal entry for the discount received on purchase by debiting the account payable and crediting the purchase discounts account and the cash account. A trade discount is the amount by which a manufacturer reduces the retail price of a product when it sells to a reseller rather than to the end customer.

In this case the company ABC Ltd. 17 January 2008 Dear all. Journal Entry of Discount Allowed and Discount Received transactionsclass 11 accountbasic journal concept with exampleuse of dr.

Journal entry for discount received is. Journal Entry for Discount Allowed and Received. Basically the cash discount received journal entry is a credit entry because it represents a reduction in expenses.

A discount is a concession in the selling price of a product offered by a seller to its customers. To Discount Received Ac. This journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount of discount allowed.

Tally PrimeERP9 Both Course PDFVideos - httpsrzpiolTally_Prime20 Course Offer with Free Softwares - Click Below LinkhttpsrzpiolOfferCourseDown. And crjournal rules for dis. Accounting for the Discount Allowed and Discount Received.

If the customer takes the discount and makes the payment on October 10 2020 the customer will receive a discount of 30 1500 x 2. It can be seen that only cash discount is reflected in the. According to nature there are.

When at the time of sales or receiving cash any concession is given to the customers it is called discount allowed. If the company uses the periodic inventory system it can make the purchase discount journal entry of 60 3000 x 2 on October 28 2020 as below. When the seller allows a discount this is recorded as a reduction of revenues and is typically a debit to a.

How do you record discount. The following journal entries show the treatment of purchase discounts depending on whether the discount has been availed or not. Prepaid expense journal entry Adjustment entries Example- April 1 2021 Bought goods for cash of the list price 100000 at 10 cash discount.

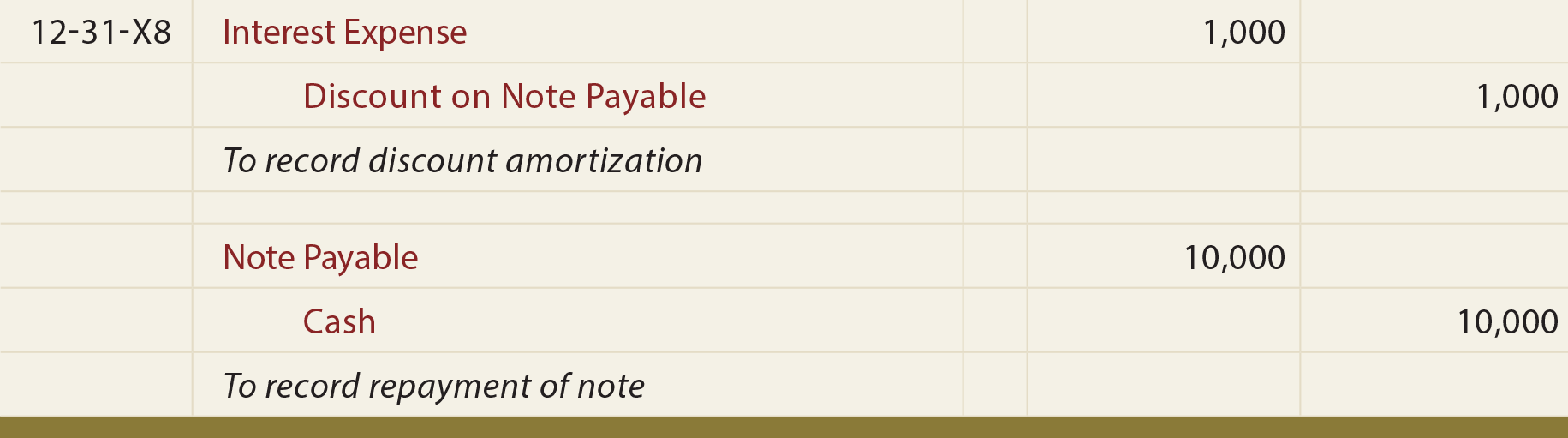

Notes Payable Issued At A Discount Principlesofaccounting Com

What Is The Journal Entry For Discount Received Accounting Capital

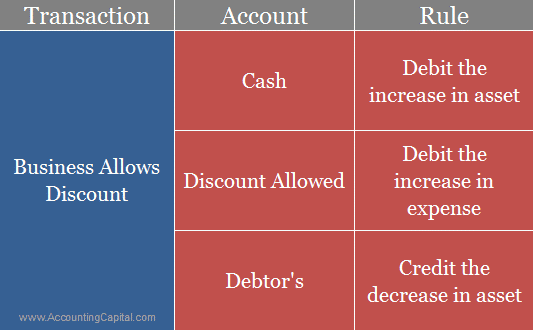

What Is The Journal Entry For Discount Allowed Accounting Capital

No comments for "Discount Received Journal Entry"

Post a Comment